free cash flow yield private equity

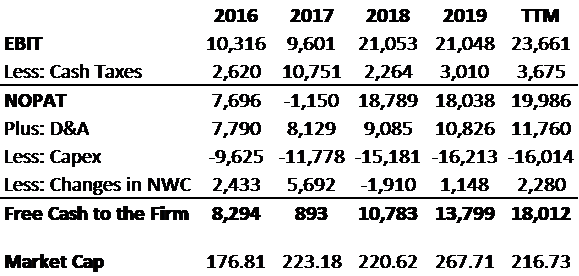

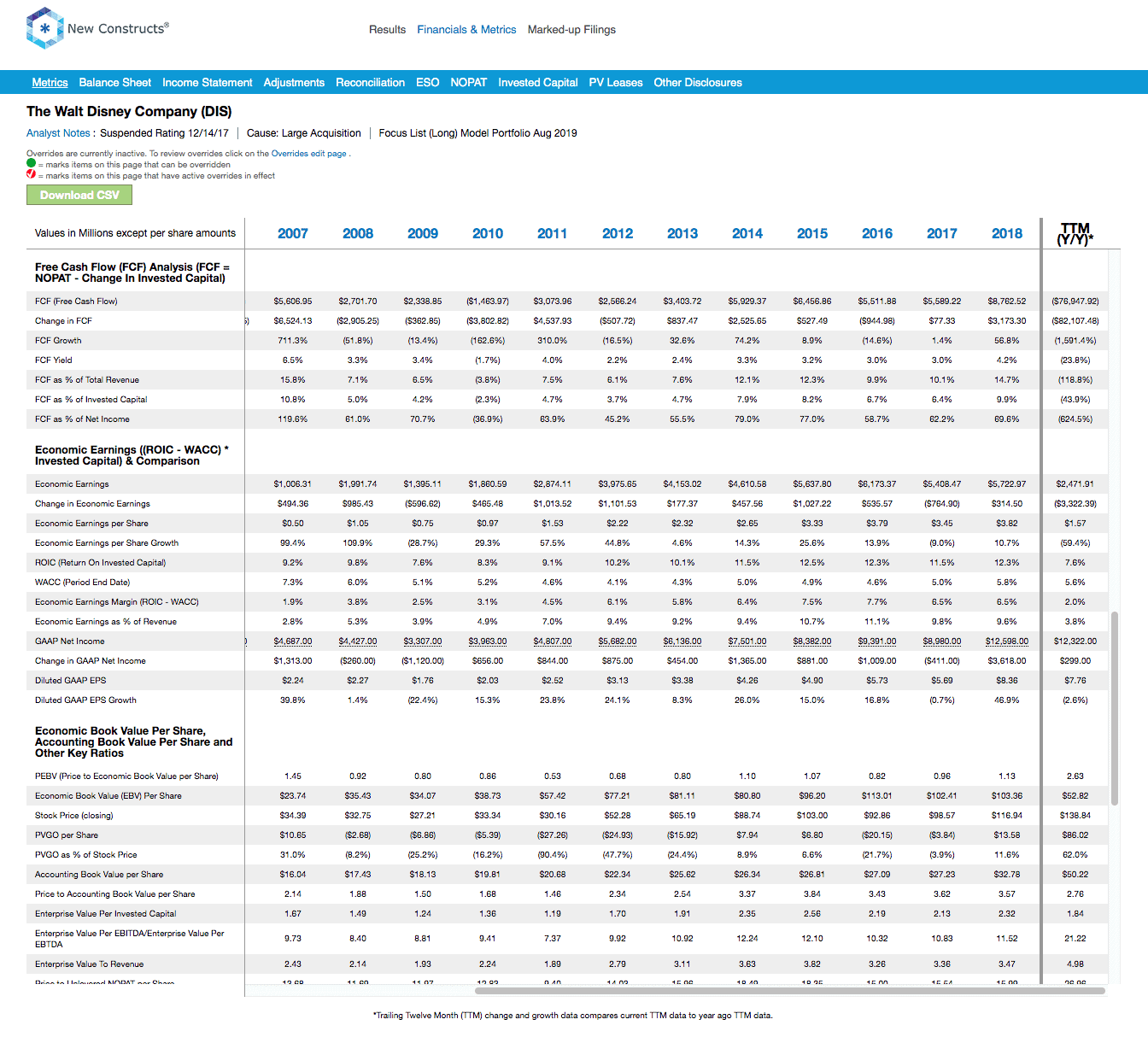

Five year average FCF Current Enterprise Value. We could also look at the free cash flow yield in relation to its trailing-twelve-month numbers or TTM to get the latest yield.

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

If the company has 200 in free cash flow last year the cash yield is 200 divided by 10000 or 20 per 1000 share.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

. Free cash flow yield is meant to show investors how much free cash flow a company generates relative to the value of its sources of funds. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. The cash yield of the stock jumps to 25.

LFCF yield measures LFCF against the value of equity while UFCF yield measures UFCF against enterprise value. Five year average free cash flow yield is defined as. Free cash flow yield is really just the companys free cash flow divided by its market value.

Heres the fun part. Free Cash Flow Yield 786. The ratio is computed by dividing free cash flow per share by the current share price.

Free Cash Flow to Equity FCFE. Cash flows rose faster than stock prices as the indexs free cash flow FCF yield rose to its highest level since 123118. Free Cash Flow Yieldfrac Free Cash Flow per Share Market Price per Share F ree C ash F low Y ield M arket P rice per ShareF ree C ash F.

It compares what you could buy a company for and what it would produce in income for you income being Free Cash Flow. FCFY is simple. Thats 2 the same as the bond.

Learn how MetLife Investment Management can help solve your unique investment needs. The free cash flow yield FCFY is a financial solvency metric that compares a companys predicted free cash flow per share to its market value per share. If company A has a market value of 100million and earns.

Quantitative Value Investing in Europe. Click image to enlarge. Free cash flow yield is really just the companys free cash flow divided by its market value.

The Formula for Free Cash Flow Yield is. Free Cash Flow is an important metric but the level of FCF by itself does not provide. Free Cash Flow Yield Free Cash Flow Market Capitalization This ratio expresses the percentage of money left over for shareholders compared to the price of the stock.

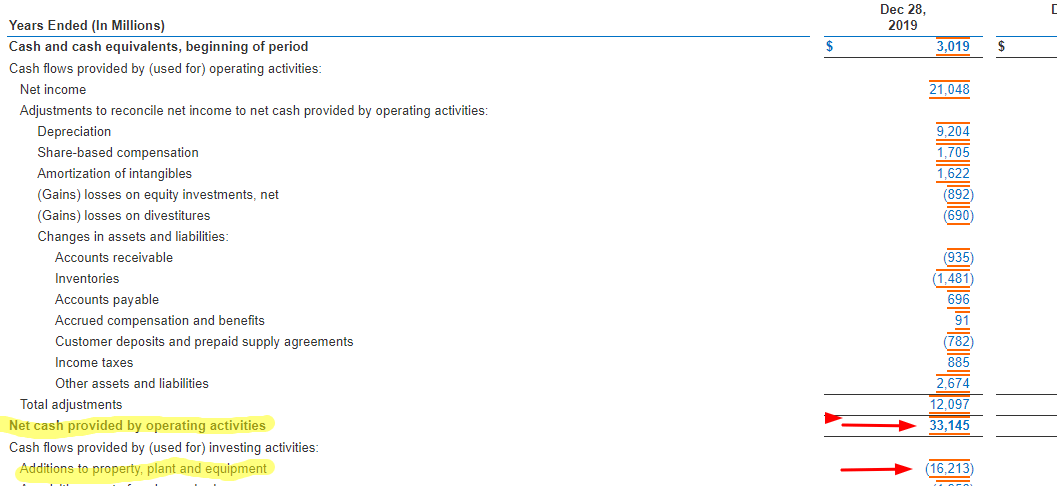

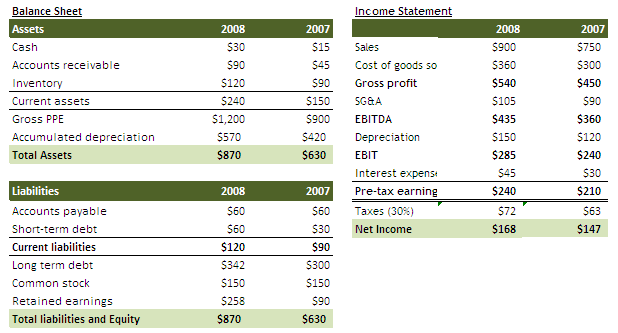

Free Cash Flow from Operations 37914. It means that the formula. Free cash flow is defined as cash from operations - capital expenditure.

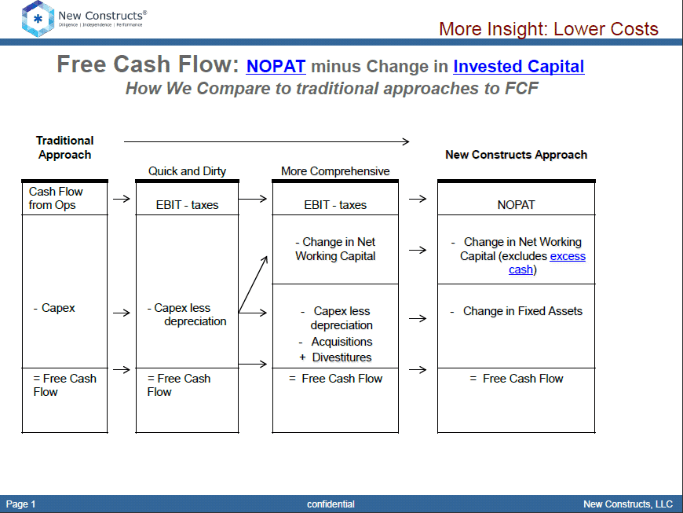

What works for achieving alpha Q1 Quintile 1 represents the cheapest 20 of companies in terms of five year average free cash. To break it down free cash flow yield is determined first by using a companys cash flow statement subtracting capital expenditures from all cash flow operations. Then the free cash flow value is divided by the companys value or market cap.

LFCF yield is calculated as levered free cash flow divided by the value of equity. Heres the fun part. Cash may be King but FCF yield is an Ace.

With the FCFE valuation approach the value of equity can be found by discounting FCFE at the required rate of return on equity r. Ad Tailored portfolio solutions to institutional investing with 150 years of expertise. Now to calculate the free cash flow yield we divide the free cash flow by the market cap of the company.

Advanced Emissions Solutions NASDAQ is a small-cap stock 201 million market cap that has a very high dividend yield 928 and an even higher FCF yield 165. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. As an analytical tool free cash flow FCF is valuable for determining a companys operating potential.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

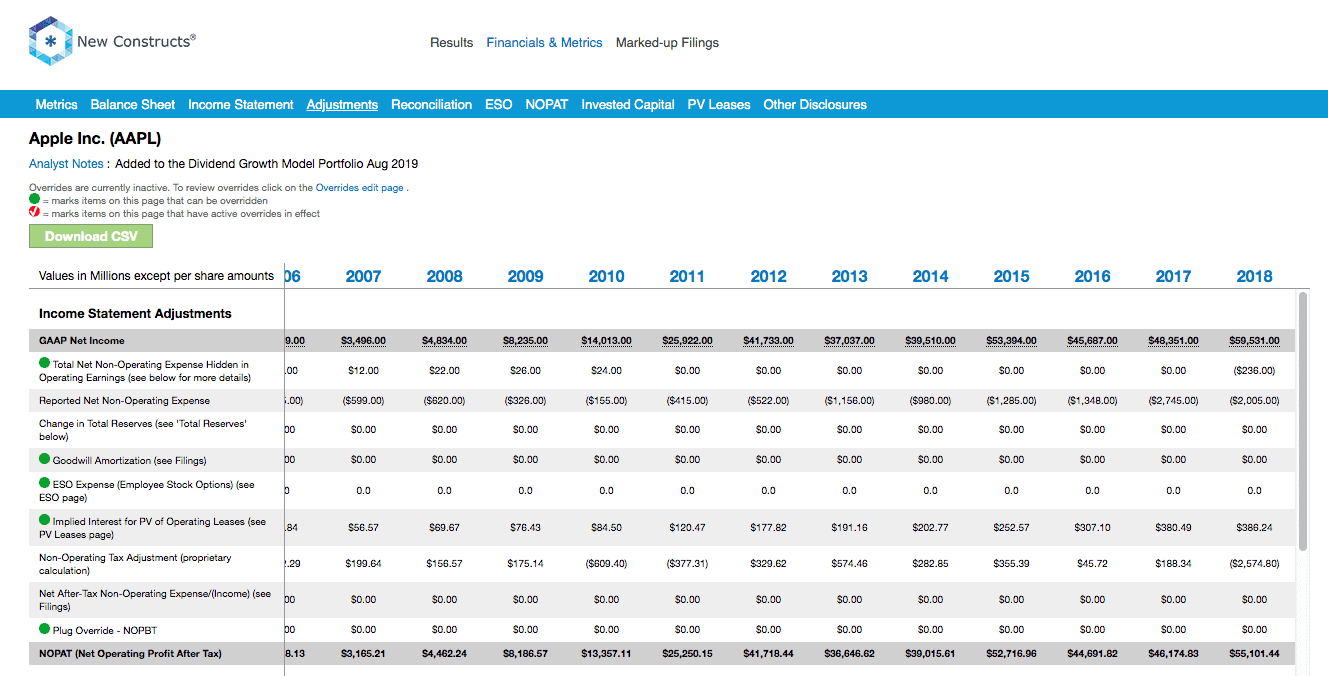

Free Cash Flow And Fcf Yield New Constructs

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Formula Top Example Fcfy Calculation

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

Free Cash Flow And Fcf Yield New Constructs

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow And Fcf Yield New Constructs

What Is The Difference Between Free Cash Flow To Equity And Free Cash Flow To Firm Quora

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Free Cash Flow And Fcf Yield New Constructs

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Explained

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth